Are scams becoming more common?

If you think scams are becoming more common, you’re right. The good news is that we’re less likely to fall for them, but we still need to remain vigilant.

The latest figures from the Australian Bureau of Statistics 1 (ABS) show 65% of Australians – that’s 13.2 million of us – were exposed to a scam last financial year.

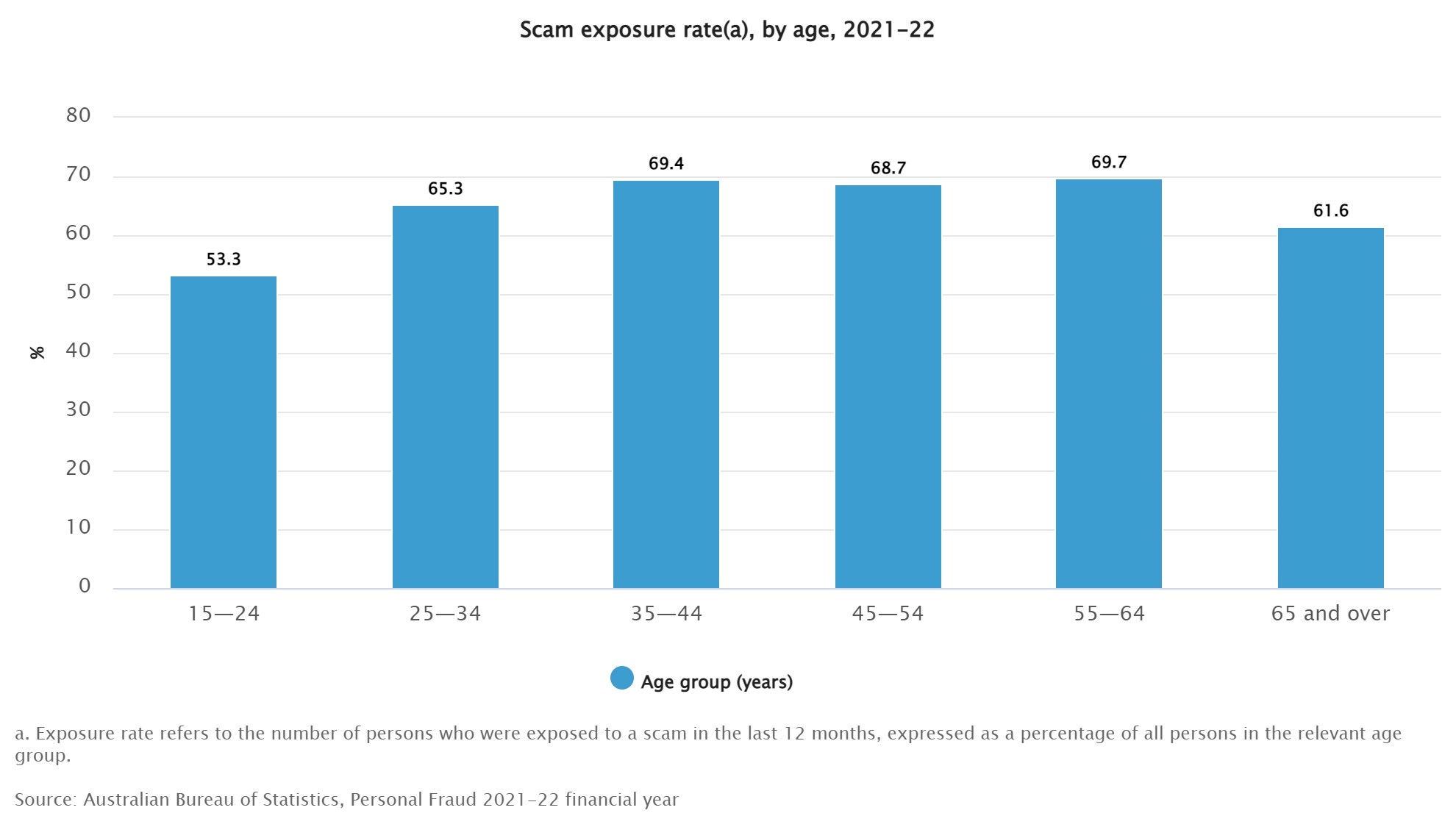

The latest figures from the Australian Bureau of Statistics 1 (ABS) show 65% of Australians – that’s 13.2 million of us – were exposed to a scam last financial year. It’s clear from the graph below that people of all ages can be the target of a scam, with the common thread being that the majority of adults had a face-to-face experience with a scam in 2021-22.

Fortunately, 12.3 million people didn’t respond to a scam.

But that still leaves over a half a million people who bit the bait by seeking further information, providing money or personal information, or accessing links associated with the scam (something that can see your device infected with damaging malware).

Top areas for scams

Knowing the danger zones can help us recognise – and avoid – scams.

According to the ABS the top 6 scams where activity has ramped up over the last year are:

- Information requests or phishing scams

- Financial advise scams

- Buying and selling scams

- Computer support scams

- Upfront payment scams, and

- Relationship or romance scams.

Card fraud, where a scammer uses someone else’s credit or debit card details to make purchases or withdraw cash, is still the leading scam, impacting 1.7 million Australians in 2021-22.

The ABS found common ways that card details fall into the hands of crooks include over the internet or by the card details being copied or obtained during use.

Worryingly, half (52%) of those who experienced card fraud last year have no idea how their personal details were obtained.

Two out of five victims don’t report the scam

Australians may be wising up to scams but many of these crimes still go unreported.

Fewer than three out of five (57%) people who experienced a scam last financial year bothered to report it to an authority.

Five steps to stay safe

If you have fallen for a scam – or you feel your personal details or bank accounts may have been compromised by a scam, it’s important to contact Community First as quickly as possible. This allows us to act fast to protect your accounts

In the meantime, a few simple steps can help you avoid becoming a scammer’s next victim.

- Be suspicious of unexpected requests to access to your devices – scammers may claim to be from reputable companies such as NBN or Telstra

- Do not open suspicious texts, pop-up windows, links or attachments that are part of emails from unknown senders

- Check your bank and credit card accounts regularly to be sure every transactions is familiar

- When shopping online look for reputable signs with a padlock icon in the website address bar

- If you’re dating online, never send money to someone you have not met in person. Nor for any reason, ever.

If you’d like to know more about how to protect you against scams, visit https://www.scamwatch.gov.au/ or call us on 1300 13 22 77.

1https://www.abs.gov.au/statistics/people/crime-and-justice/personal-fraud/latest-release

1300 13 22 77

1300 13 22 77